Do you hear the people sing?

Singing the song of angry men?

It is the music of the people

Who will not be [RECORD SCRATCH]

Set your ear close enough to the baseball streets this offseason and you’re likely to hear pro-labor voices uttering that conspiratorial word most foul: “collusion.”

Nobody seriously thinks MLB team owners are colluding—in the illegal sense—to suppress player wages, of course, but you know the hot stove has been extremely cold when the most exciting transactions involve teams hiring baseball writers to fill analyst positions. That’s enough to raise some suspicion and start a conversation. Indeed, it’s not as if the owners don’t know how to collude; after all, they’ve done it before. If owners truly were colluding now, though, what would it look like?

Defining terms is a good place to start and, for a legal definition of “collusion” in the sense we’re seeking here, Black’s Law Dictionary (8th ed.) directs us a few pages ahead to “conscious parallelism”:

An act of two or more businesses in a concentrated market intentionally engaging in monopolistic conduct.

“Monopolistic conduct,” it turns out, does not involve winning $10 in a beauty contest, but instead “the power to fix prices … within the relevant market, and … the willful acquisition or maintenance of that power.”

Of course, Major League Baseball is a monopoly (or an oligopoly, depending on how you look at it), so these definitions don’t seem overly helpful for identifying the sort of actions for which we’re looking. The idea of “conscious parallelism” does, though, so let’s take that notion and head about a mile north from Nationals Park, where the Supreme Court can lend an interpretive hand.

In a 2007 decision in Bell Atlantic Corp. v. Twombly, 550 U.S. 544, a consumer class action lawsuit against operators in the telecommunications industry alleging violations of federal antitrust law, the Supreme Court agreed with the trial court’s decision to dismiss the case. Justice David Souter, writing for the Court, explained the difference between, in a lower court’s terminology, collusion and coincidence, noting that “even ‘conscious parallelism’ … is not in itself unlawful”:

The crucial question is whether the challenged anticompetitive conduct stems from independent decision or from an agreement, tacit or express. While a showing of parallel business behavior is admissible circumstantial evidence from which the fact finder may infer agreement, it falls short of conclusively establishing agreement or itself constituting a Sherman Act offense. Even “conscious parallelism,” a common reaction of firms in a concentrated market that recognize their shared economic interests and their interdependence with respect to price and output decisions is not in itself unlawful.

The inadequacy of showing parallel conduct or interdependence, without more, mirrors the ambiguity of the behavior: consistent with conspiracy, but just as much in line with a wide swath of rational and competitive business strategy unilaterally prompted by common perceptions of the market.

Accordingly, we have previously hedged against false inferences from identical behavior at a number of points in the trial sequence. An antitrust conspiracy plaintiff with evidence showing nothing beyond parallel conduct is not entitled to a directed verdict.

550 U.S. at 553-54 (internal quotation marks, citations, brackets, and ellipses omitted). Thus, the Court reached its memorable (to some!) conclusion on this point:

An allegation of parallel conduct and a bare assertion of conspiracy will not suffice. Without more, parallel conduct does not suggest conspiracy, and a conclusory allegation of agreement at some unidentified point does not supply facts adequate to show illegality. Hence, when allegations of parallel conduct are set out . . . they must be placed in a context that raises a suggestion of a preceding agreement, not merely parallel conduct that could just as well be independent action.

Id. at 556-57.

In other words, to be illegal under section 1 of the Sherman Act, collusion requires a prior agreement; mere parallel conduct, alone, is not enough.

MLB and its member clubs technically are not subject to things like the Sherman Act by virtue of the league’s antitrust exemption (which recently has faced legal challenges in the context of wage lawsuits by team scouts and minor-league players). The Collective Bargaining Agreement between the teams and players prohibits team collusion with respect to matters including free agency and minor-league assignments, however, and I believe that the basic principles set out in the Twombly decision, quoted above, would guide an inquiry under Article XX(E), which provides, in part, that “Players shall not act in concert with other Players and Clubs shall not act in concert with other Clubs.”

It’s one thing to present sufficiently plausible allegations of collusion (something the Twombly plaintiffs failed to do), however, and another to win on a collusion claim, but that’s exactly what the MLBPA did in the mid-1980s when arbitrators determined that, under the guidance of MLB commissioner Peter Uberroth and player relations committee chair Lee MacPhail, the league and its teams colluded to limit free-agent signing during multiple offseasons. As Zack Moser explained in a well-annotated piece for BP Wrigleyville, the circumstances at that time were fairly extreme and involved major stars like Kirk Gibson, Andre Dawson, and Tim Raines. Importantly, they also included public and publicly reported statements by Uberroth, MacPhail, and team owners about the limiting of free-agent signings.

In terms of collusion, the question for the 2017-2018 offseason is not “how cold is the hot stove?” but “why is the hot stove cold?” While some, like Moser, believe that “the evidence for collusion is mounting, and ample,” and Ben Diamond, in these pages, described an historic “collapse[]” in free-agent spending that, to him, seems to point toward improper collusion, I don’t reach the same conclusion. What we do not have, now, is good evidence of an agreement between teams to avoid or limit the signing of free agents. I’m not even convinced we have good circumstantial evidence of such an agreement.

At most, I think we have evidence of that term from way up at the top of your screen, “conscious parallelism,” which Justice Souter described as “a common reaction of firms in a concentrated market that recognize their shared economic interests and their interdependence with respect to price and output decisions [that] is not in itself unlawful.” Simply put, we are seeing individual teams act rationally in response to the rules, forces, and information applicable to their hiring market.

The only agreement we do have is the new Collective Bargaining Agreement, which includes, among other things, a more aggressive luxury tax that, as Nathaniel Grow was one of the first to recognize, effectively serves as a soft salary cap. Those who see collusion around every corner contend this CBA component itself constitutes a collusion compact, or at least coordination to create a cover for collusive conduct. This meta-argument doesn’t hold water. The agreement requirement pertains to an agreement between the allegedly colluding parties, exclusive of their purported victims. Here, the players, through their union, are parties to the CBA. They agreed to this deal.

That may have been an unwise decision, but it wasn’t an unconsidered one, and both sides came to the table with sufficiently equal bargaining strength. Unless the position is that the CBA isn’t a valid contract, this boils down to an argument that teams are colluding because they pursued their self-interest in the context of the CBA negotiations, and if that is collusion, then everything is collusion and the term has no independent meaning. (Were the players colluding when they negotiated minor-league option and assignment restrictions, minimum salaries, or 5/10 rights under the CBA? Surely not.)

Returning to the luxury tax, we are seeing teams behave rationally in the face of a sharply and severely escalating penalty structure, and it isn’t all about shying away from big free-agent signings. Probably the best example of this rational response is what we might as well call “The Brandon McCarthy Trade (no not that one, the other one).” Rob Mains’ Transaction Analysis gets to the larger purpose of this trade and why it’s an exemplar of teams’ appropriately rational behavior under the new CBA:

For the Dodgers, this is all about the competitive balance tax. The team’s 2017 payroll, as calculated for the tax, was $253.6 million, resulting in a $36.2 million charge, according to the Los Angeles Times. The Dodgers were well over the $195 million threshold. Teams that exceed the threshold in their first year pay a penalty of 20 percent of the contract value of the overage. In the second year, the penalty rises to 30 percent. In the third year and beyond, it’s 50 percent. The Dodgers were over the limit for the fifth year, and they were subject to additional surcharges as well.

The new luxury tax regime isn’t a constant; it’s cyclical. It just so happens that the Dodgers, based on where they happen to fall in that penalty cycle, needed to hit the reset button now. There’s no indication that they won’t continue their big-spending ways next year.

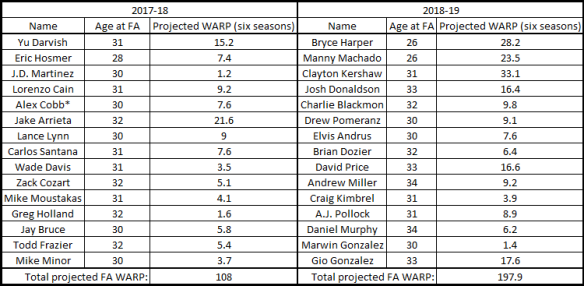

Speaking of next year, the 2018-2019 free agent class is, well, a class above the current one, and it isn’t just your favorite baseball insider who’s figured that one out. Name recognition alone should be sufficient, but this is Baseball Prospectus, so let’s look at some numbers. Based on currently available data, a comparison of PECOTA’s six-season cumulative projected WARP (i.e., 2018-2023 for current free agents and 2019-2024 for next year’s free agents) for the top 15 free agents in each class looks like this:

*PECOTA only projects Alex Cobb through the 2022 season.

The message from PECOTA is unequivocal: focusing on the top options, there are almost twice as many wins available in next year’s free-agent market as there are in this year’s. Even without the current luxury tax system, I think we would see teams cutting payroll in 2018 to load up for 2019.

This, in turn, points to a third, and even broader factor: the homogenization of player-valuation methodology across teams. From on-base percentage to pitch-framing to launch angle, the public has every indication that teams have, at last and in their own ways, made the climb to the same “advanced” plateau where things like the Dansby Swanson trade don’t happen. Teams are mining everything from biometric data to psychological analyses in search of the next competitive inefficiency (witness Theo Epstein’s comments over the past year about team chemistry, as one example), but for now we have good reason to think that they’re all working with the same basic playbook and using the same basic terminology. It should come as no surprise, then, that teams would see similar risks in many of this year’s free agents and respond similarly.

(Let’s not forget the players’ side, either. At least one of the remaining free agents, Eric Hosmer, reportedly is sitting on multiple seven-year contract offers, so it’s not as though teams are completely ignoring these guys. Hosmer, like J.D. Martinez, Jake Arrieta, Mike Moustakas, and Greg Holland, among other current free agents, employs Scott Boras as his agent, and, as David Cameron observed in one of his final public baseball statements, when it comes to free-agent deals, Boras “notoriously takes a very long time with his clients. … He carries his top guys later into the offseason that anybody else.” A risky strategy, perhaps, but a reminder that all of these deals have at least two sides.)

On an individual basis, are there teams that, in bad faith, refuse to spend enough to be competitive and, for example, point to narrative constructs like “market size” to try to excuse their behavior? I think so. The luxury tax structure is real, though. So is the disparity in likely free-agent value this offseason relative to the upcoming offseason. Teams’ convergence on player-valuation methodology and philosophy seems to be real, too. On the other side, all we really have that might point to collusion is one slow hiring period, which, by itself, is not persuasive evidence of an antecedent agreement between teams to collude against players.

Beyond the legal definitions and theories of collusion, it’s worth emphasizing that this entire subject, as currently considered, arises out of patterns observed in a single offseason that isn’t even over. Meanwhile, the explanatory factors—e.g., the luxury tax and 2019 free-agent class—all reflect multi-year circumstances. If, heading into the 2019 season, there aren’t bidding wars for Bryce Harper, Manny Machado, and Clayton Kershaw (assuming he opts out after this season) and the Dodgers continue to shed payroll, for example, that might fuel a whiff of genuine collusion that legitimates an investigation into the existence of an anti-competitive agreement between teams. Until then, the sample size simply is too small to permit a determination that the observed behavior is the result of anything other than expected cyclical dynamics.

Alec Denton is a lawyer in Atlanta. The foregoing neither constitutes legal advice nor establishes an attorney-client relationship between you and him.

Thank you for reading

This is a free article. If you enjoyed it, consider subscribing to Baseball Prospectus. Subscriptions support ongoing public baseball research and analysis in an increasingly proprietary environment.

Subscribe now

For example, Moustakas is listed as age 31, when he is in fact 29 this year. Which may have affected his 6 year WARP projection of only 4.1, which is somewhat strange given he is just coming off of a 1.9 WARP year, and is largely projected to to continue that for at least a few more years.

I do believe there is something else at play. The teams with the most money are all really really good.The Yankees, Cubs, Dodgers and Astros are all at the top of the sport and there is little incentive for other teams to spend money keeping up with them right now. Seems there are an amazing number of clubs willing to be mediocre in 2018. That is 4 of the Top 6 MSA's. Throw in Washington and you have half of the top 10 being dominant for the short term. Throw in that 2 more top 10 market teams Philadelphia and Atlanta are right on the cusp of competing there really isn't a real difference maker available.

I was also baffled by some of the WAR projections (JD Martinez is a 1.2? Gio Gonzalez is a 17.6, more than Yu Darvish at 15.2?), but admittedly don't have time right now to check them myself ¯\_(ツ)_/¯

What are new are the surtaxes that kick in above $20 million over the luxury tax line and then go higher still at $40 million over the luxury tax line, as well as a team $40 million over the line seeing its highest draft pick move back 10 spots.

Additionally, the QO system has been changed so that being under vs. over the luxury tax in a given year now impacts how a team is treated both when signing QO'd players and its own losing QO'd players. Being over the luxury tax means giving up both more draft picks and more IFA pool money when signing a QO'd player. It also means getting a worse draft pick when losing its own QO'd player.

So I see two impacts from those new elements of the luxury tax.

For teams like the Yankees and Dodgers who expect that they may be well over the luxury tax line in future years, it's not just re-setting penalties but also trying to stay under the $40 million threshold above which there's a draft penalty and the luxury tax on incremental dollars can reach 95%, almost dollar-for-dollar. Free agent contracts are of course generally multi-year deals, so they're looking ahead and seeing what those contracts may mean for how much they're over the luxury tax in 2019 and beyond.

For teams who float right around the luxury tax line (such as the Cubs, Giants, and Nationals), there's some incentive to be a couple million under the tax line rather than a couple million over the tax line if they think that they're going to be signing QO'd free agents or losing some of their own QO'd players in future years.

Of the division races, only one (the AL East) projects to be truly competitive (per Fangraphs projections). The NL Central projects to be semi-competitive, and the expected winners look like big favorites in the other four divisions. Even the number of projected wild card contenders are fairly limited, especially in the AL where the Angels appear to have pulled well ahead of the pack for the second wild card after getting Ohtani and then adding Kinsler and Cozart to fill their two biggest position player holes.

So there just aren't that many teams scratching and clawing to find that extra incremental win or two, neither the expected playoff teams nor the teams chasing them. It's an oddly stratified set of teams. To simplify slightly, it's the division favorites, then the wild card favorites, and then everybody else. And the so-called super-teams, the best of the division favorites, often lack big holes that present obvious ways to improve their rosters.

Compounding that, a number of trades (Stanton, Ozuna, Gordon, Cole, Longoria, Kinsler, and McCutchen) have filled holes for teams that we might otherwise have expected to find upgrades in free agency. Those trades do truly take away potential demand for free agents: the teams trading these players away are making those trades because they're not at a point on the win curve to want to pursue free agents, or at least not ones beyond bargains to fill out the roster.

So what's the possible end result? Limited bidders for free agents, which makes waiting a more attractive option for teams. Smart front offices almost certainly have a sense of these dynamics: Where else do we think this player might go? Who are other options if we don't sign this player? What are the number of likely landing spots in total for all of these players? If a team makes an offer to Mike Moustakas, for example, and thinks of Todd Frazier as its back-up option, just what are two teams that seem likely to sign free agent 3B's except perhaps to opportunistic, team-friendly contracts? I think it's probably a similar story with pitchers as teams think about making an offer to Darvish or Arrieta, with Lynn or Cobb as back-ups. The first two are obviously better than the latter two, but a team can probably feel good about getting one of the four if needs to fill a rotation spot, and the current projections don't support the idea that the incremental one or two win difference in 2018 matters all that much to many teams. If it looks like five or six teams who each really need an incremental win or two are chasing four players, by contrast, then there's a clear incentive not to be left as the last teams(s), missing out on all of those players.

There are some obvious limits to these dynamics, because even bad or mediocre teams will acquire good players if salaries drop far enough. They're potential fodder for trades in the future if nothing else, and some teams will almost certainly surprise on the upside or downside and unexpectedly change the dynamics of in-season playoff races (with potential trade demand implications). We've to some degree see this happen before, though, where a last free agent left in a segment of the market has limited demand (perhaps only real demand from a single team) and therefore signs for much less expected. It happened in 2016 when Fowler re-signed with the Cubs for less than the qualifying offer that he'd rejected, and in that same offseason Desmond also signed with the Rangers for less than the qualifying offer that he'd rejected.

My overarching point is that I think the free agent market bidding dynamics are normally driven by a little bit extra demand relative to supply and that drives "front office FOMO" that pushes the deals up that last bit to the point where we're often left scratching our heads at what look like overpays. This year, though, expected playoff race dynamics, a lack of super high-end free agents, and an active trade market have taken off that extra edge of demand and left either a balanced or slightly oversupplied free agent market at a lot of positions. It simply doesn't take much less demand for the market to pull back compared to what we're used to seeing.